extra debit card nerdwallet

Empower Debit Card. The best prepaid debit cards or reloadable prepaid cards have low or no monthly fees and offer many ways to add and withdraw money.

The Credit Building Debit Card Extra Debit Card Review Youtube

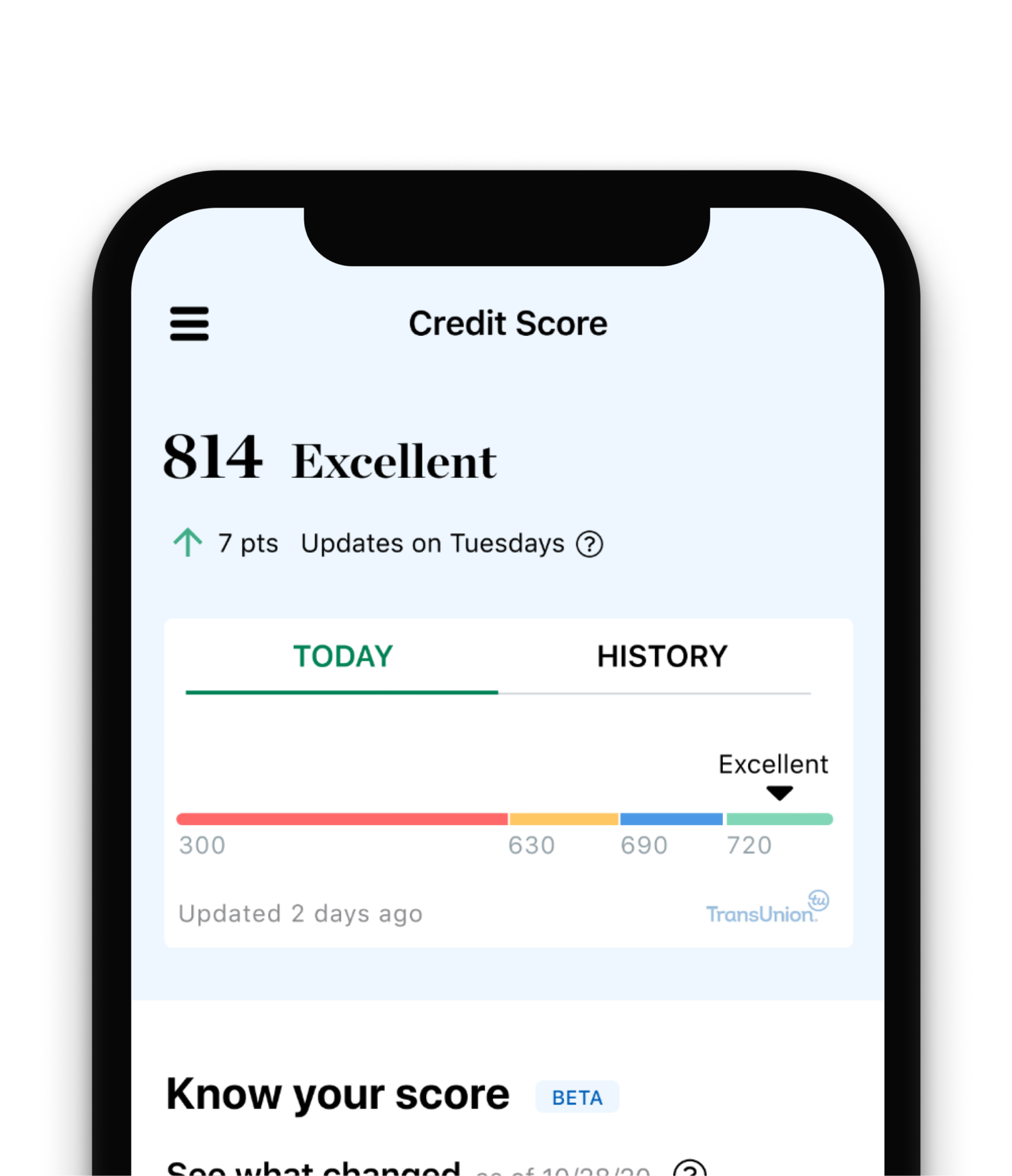

Failure to maintain a current balance on your Extra Debit Card account may result in delinquent reporting to credit reporting agencies which may negatively impact your credit.

. How Much Does the Extra Debit Card Cost. The Extra debit card has a few standout features that might entice you to open an account. You don t need a bank account to get a postpaid debit circuit board but it s a necessity for a regular debit wag which is linked to your checking account.

Empower is a personal finance app offering a cash back debit card. 7 per month billed in 1 lump sum of 84 per year or 8 per month month by month. These ACH debits typically deduct funds from your Partner Account within 2 to 3 business days after initiation by Extra.

Chime is not a bank. Youll have to call them at 833-984-2291 or the number on the back of your debit. If you choose to spend on a credit-building program the Extra debit card is a low-risk way to do it.

See our top picks. Reports adversely to credit reporting. Extra was founded in 2019 so its a relatively new company.

For postpaid debit cards you load the card with money when you get it then use it to make purchases. For the basic level Credit Building only it is 7 a month if you pay for a year up front or 8 per month if paid monthly. Extra Debit Card Review.

All 32 team cards are available customized with your favorite teams colors and logo. The Extra Debit Card. Extra debit card nerdwallet Tuesday May 3 2022 Edit.

Add me on IG. It is a legitimate way to build your credit score. Monthly or Annual Fee.

6 things youll like about the Extra debit card. The Extra Debit Card is offering cardholders an opportunity to build credit history earn reward points similarly to a credit card. For Credit Building and Rewards it costs 9 per month if you pay for a year up front or 12 per month if paid monthly.

To get started the card is charged as a debit card you start out with a 100 line of credit and you have two options 8mo to just use the card as an extension of your bank account which probably already comes with a card except this one is clear and has a 60 tint on the translucent part or the 12mo option which gives you access to the credit reporting and credit building. Ad No-Fee ATM Access. 7401 Featherston Cv Olive Branch MS 38654-9020.

The card does not allow cash advances or. Meet the credit building debit card. The annual fee is 0 and you wont be charged late fees over-limit fees or foreign transaction fees.

Good budgeting and a cap on purchases cool rewards shop and good cash back. Extra is neither a secured credit card nor a checking account. Httpsbitly3kdvgfI Get your next desk from Flexispot httpsbitly2T5Gl.

Univision MasterCard The Univision MasterCard minimizes the number of different fees cardholders are. The Extra debit card isnt accredited by the BBB yet although its in the process of membership approval. Within 30 days of the date of each transaction made using your Extra Debit Card Extra will initiate one or more ACH debits to deduct equivalent funds from your Partner Account.

Every purchase you make with your Extra card helps you build credit and theres no. Get the Cleveland Browns Extra Points Credit Card card today. Earn up to 2 cash back.

8 and up depending on the plan you choose. Extra Card has created a debit card that allows people build credit without a credit check or a high credit score to qualify. This card is a fantastic alternative if you want to improve your credit without having a credit check accrue debt or pay interest on your purchases.

Heres a rundown of Extra debit card features. If you do make this choice though it should be an informed choice. Heres a review of two halfway decent prepaid debit cards that target the Hispanic demographic.

The Extra debit card is unlike most debit cards in that it can help you improve your credit and earn reward points. Prepaid debit cards vs. For many people 84 per year may be an acceptable cost for building credit without the risk of mismanaging a credit card.

See credit cards more. Theres no credit check when you apply for an Extra card so almost anyone can qualify. Your spending limit is based on your bank account balance.

The Extra Debit Card.

How Foreign Students And Immigrants Can Get A Credit Card Nerdwallet

Credit Card Vs Debit Which Is Safer Online Nerdwallet

Best Credit Cards For Entertainment Spending Nerdwallet

Extra Debit Card Review Nerdwallet Archives Meratopic

Extra Debit Cards Claiming To Build Credit R Personalfinance

Embarrassed Americans Underreport Credit Card Debt By 415 Billion

Credit Card Reviews By Nerdwallet S Experts Nerdwallet

Can T Get A Credit Card Try These Alternative Options Nerdwallet

%20copy.jpg)

How Does Extra Work Extra Blog

Extra Debit Card Review Builds Credit Earns Rewards Like A Credit Card

Extra Debit Card Review Can You Really Build Credit With A Debit Card

How Debit Card Foreign Transaction Fees Work Nerdwallet

Can T Get A Credit Card Try These Alternative Options Nerdwallet

What To Do If You Lose Your Debit Card Overseas Nerdwallet

Nerdwallet Hispanic Prepaid Debit Cards A Review And Comparison Fox News